A report ranking Australia’s largest 100 residential builders has been released, revealing that last financial year the group produced lowest number of houses in 15 years.

The HIA-Colorbond Steel Housing 100 Report ranks the nation’s largest 100 residential builders based on the number of homes started each year.

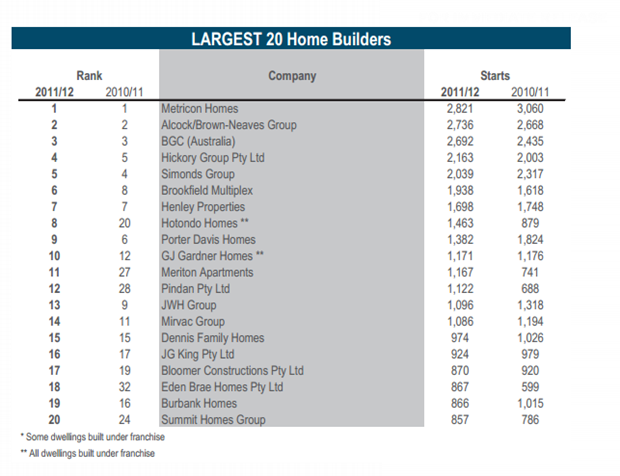

It revealed Metricon as Australia’s largest residential builder in 2011/12 with 2,821 starts, all of which were detached homes. It is the second year running Metricon has been ranked as Australia’s largest home builder.

In terms of the largest 20 builders, all were in the Housing 100 the previous year, but four builders moved into the top 20 in 2011/12 from outside that ranking range – Pindan Pty Ltd, Meriton Apartments, Eden Brae Homes and Summit Homes Group.

The number of Housing 100 starts fell by 7.3 per cent to 48,130 in 2011/12, their lowest level since 1996/97.

“This result is consistent with the overall experience of the industry in 2011/12 where new home building conditions weakened considerably across Australia,” said HIA Chief Economist, Harley Dale.

In 2011/12 the largest 100 builders started 35,909 houses (down 11 per cent from 40,183) and 12,221 units and townhouses (up 4 per cent from 11,720). The largest 100 builders held a 35 per cent share of Australia-wide housing starts, up slightly from 33 per cent in 2010/11, but below the historical average of 36 per cent.

Alcock/Brown-Neaves Group was ranked Australia’s second largest builder in 2011/12 with 2,736 starts, building in the markets of Western Australia and Victoria.

Western Australia builder BGC (Australia) was ranked third with 2,692 housing starts.

Hickory Developments Pty Ltd was the nation’s largest multi-unit builder for the third consecutive year with 2,163 starts. This result moved the company up the overall rankings ladder from number five in 2010/11 to number four in 2011/12.

Seventeen builders who featured in the 2011/12 Housing100 did not make the list the previous year.

Dale added: “The Housing 100 and the entire industry can deliver, and indeed Australia's residents have the requirement for, a considerably higher level of housing starts than has been evident over the last couple of years,” said Harley Dale.

“Within an environment of subdued demand conditions, both unilateral and cooperative policy reform could generate a much healthier year for new home building in 2012/13. Sadly, evidence of the will to execute such policy action remains far slimmer than Australia requires,” he said.

The AFR reports that the HIA and Deutsche Bank expect an improvement in the housing construction market; the Bank predicts housing approvals will rebound from the first quarter of next year, the largest recoveries in home building expected in Western Australia and NSW, with declines in Victoria.