The Housing Industry Association’s spring 2012 edition of its National Outlook points to a mild, narrow recovery in new housing starts in 2012/13, together with a modest improvement in renovations activity.

"From a starting point where new home building is back in recession and renovations activity has declined over four consecutive quarters, there needs to be some evidence by now of improved prospects on the horizon," said HIA chief economist, Dr Harley Dale.

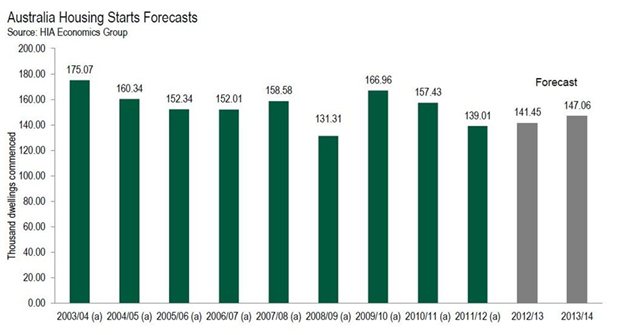

"There is some evidence of an impending recovery, but it remains far from compelling. Nevertheless, we are still forecasting a recovery in housing starts in 2012/13, with a mild increase of 1.8 per cent driven by New South Wales and Western Australia. Renovations activity is forecast to grow by 1.6 per cent this financial year following a 2.7 per cent decline in 2011/12."

"There are a range of factors that will constrain a recovery in residential construction, including an on-going process of household deleveraging, the lack of full pass-through of interest rate cuts, tight credit supply, and governments failing to reduce the excessive taxation of new housing."

"A mild recovery in 2012/13 will be driven by interest rate cuts (which will provide some impetus), new home incentives in a handful of states, and some focus on policy reform in NSW," said Dale.

"The short term recovery essentially rests with NSW. If it doesn't happen there then national housing starts will fall for a seventh time in nine years."

The report says housing starts cycle is forecast to bottom in the 2012 calendar year at a level of 136,809. That would represent a decline of 9.3 per cent and on current evidence the risk resides with a weaker outcome.

Starts are forecast to increase by 4.5 per cent in 2013 and 7.0 per cent in 2014, reaching a level of 152,983.

On a financial year basis, the forecast 1.8 per cent increase in housing starts in 2012/13 follows a decline of 11.7 per cent in 2011/12 where starts fell in every state and territory. Starts are forecast to increase by a further 4.0 per cent in 2013/14 to a level of 147,060.

The forecast 1.6 per cent rise in total renovations investment in 2012/13 would take activity to a value of $29.61 billion.

Growth of a further 1.2 per cent is forecast for 2013/14. That would take the value of renovations activity to a new record of $29.958 billion, just surpassing the $29.956 billion mark of 2010/11.

Dale added: "The catalyst for a widespread and sustainable recovery is policy reform to reduce the excessive and inefficient tax bill that renders new housing the second most heavily taxed sector of the Australian economy."

"Governments of all levels can't sit back and presume that lower interest rates alone will reignite new home building activity back to healthy levels, because they won't."