Tendering is a prudent and well accepted way for architects and project managers to get value for money for their clients on construction projects. Pick a short list of builders with appropriate experience, resources and reputation and issue them with documentation to a professional standard and one has eliminated most of the undertake the work. And it goes without saying that the competitive process drives the pricing in line with the best current market rates.

Economic commentators are pointing to a resurgence in construction activity picking up the slack in declining capital investment in the mining and resources sector – so why is there a general impression that construction tendering is in the doldrums?

Of course the construction industry is not uniform. Currently residential work is racing ahead but not so the commercial, industrial and other non-residential sectors.

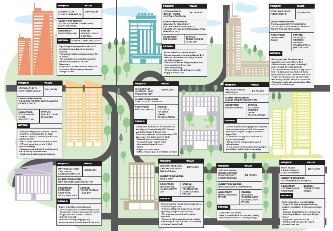

As shown (below image), there are some substantial residential projects out to tender and recently awarded, however, a large proportion of this work is either negotiated or undertaken directly by the developer (often referred to as owner/builder projects). Instead it is the non-residential sector that typically generates tendering activity and this is still underperforming.

Another major source of tenders is the public sector and in particular the State Governments, who have been pretty vocal about how difficult they are finding it to make ends meet (the exception being in relation to infrastructure projects, for which the civil engineering sector is most grateful!). Even the Reserve Bank has noted this situation – its preferred turn of phrase is “Public spending is scheduled to be subdued”.

[Click image to open a PDF infographic on Infolink and BCI's project activity snapshot]

[Click image to open a PDF infographic on Infolink and BCI's project activity snapshot]

Yet the flow of tenders is far from running dry. The enclosed extracts from BCI Australia’s database illustrate the range of construction activity both in contention and ready to go - and there is more to come. We have also been observing that the construction “pipeline” continues to build with increasing numbers of projects waiting for the green lights.

In turn, those green lights are waiting on the development of favourable sentiment. According to economic commentators such as the NAB (National Australia Bank), business confidence has been growing although improvement in business conditions has been lagging. Consumer confidence also had been rising but the scary Federal Budget has given that a bit of a thumping.

Nevertheless, taking the wider view and again quoting the Reserve Bank “… continued accommodative monetary policy should provide support to demand, and help growth to strengthen over time”. And another line from their Interest Decision Statement, 3 June 2014 “Signs of improvement in investment intentions in some other sectors are emerging, but these plans remain tentative, as firms wait for more evidence of improved conditions before committing to significant expansion.”

Therefore, it seems quite likely that as the favourable evidence accumulates, those commitments will get signed off and the backlog of construction plans will hit the tender market. This will be welcome news for the builders who are actively in the tender market.

Promotional Content

It should be recognised that tendering is a demanding exercise for builders and their subcontractors. With this very much in mind, BCI is currently introducing its new TenderManager online service.

By streamlining the routine tasks of sorting documents, defining what documents are required by each of the trades, selecting the subcontractors in each trade and monitoring the responses, BCI TenderManager releases the builders’ estimators from the mundane tasks to come up with new ideas for the cost effective delivery of the project.