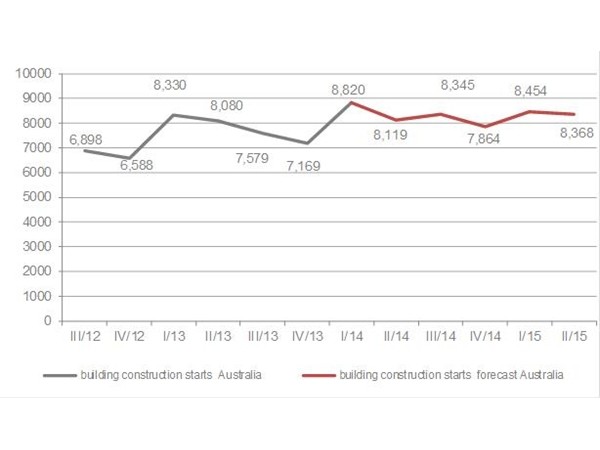

Independent research shows the value of building construction activity in Australia in an upward trend, with residential leading the charge. This exclusive data is collated by construction information specialist BCI Australia.

Relatively consistent from quarter to quarter, 2014/2015 is set for $33 billion of building construction activity, up over 4 per cent from 2013/2014. The only slight dip expected will be in 4th quarter 2014 where activity will drop just below $8 billion.

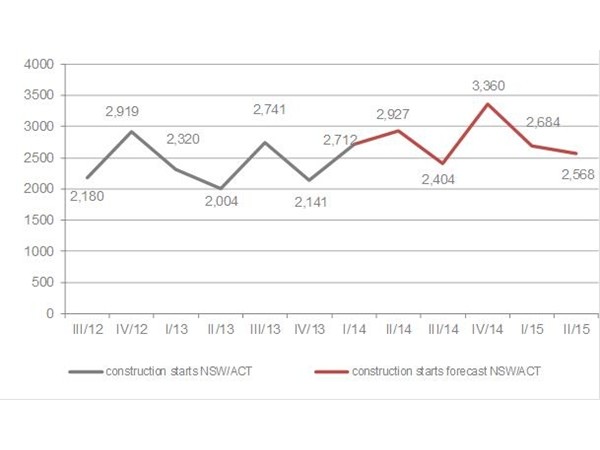

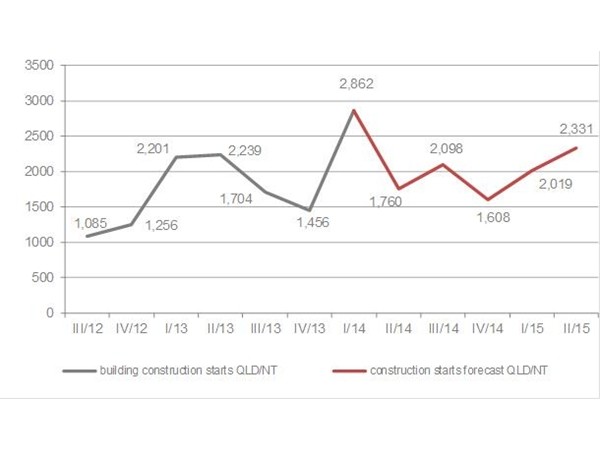

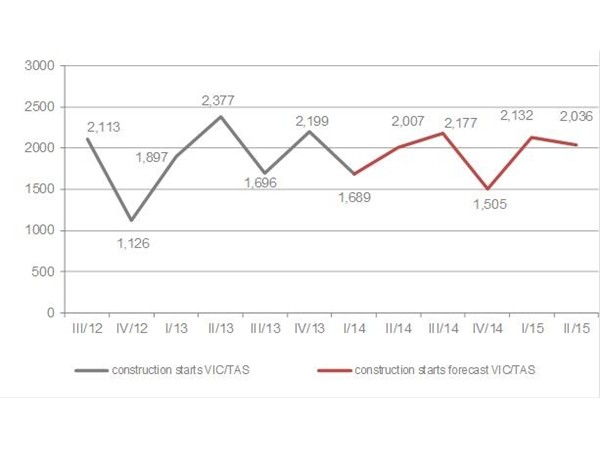

*Graphs below are in millions of dollars measured quarterly.

Australia – Outlook for Building Construction Projects

Construction starts by state

The forecast for the NSW/ACT building market is the most positive on the whole and across the majority of sectors. In 2014/2015, the increase is expected to be up to 5 per cent with the peak being 4th quarter 2014.

NSW/ACT - Outlook for Building Construction Projects

QLD/NT - Outlook for Building Construction Projects

QLD/NT is the only other market expected to grow in both 2013/2014 and 2014/2015.

Thanks to an influx of building in early 2014, this financial year provided nearly 15 per cent more work than the year prior. If expected work goes ahead as planned, 2014/2015 should see the QLD/NT building market to increase to over $8 billion.

VIC/TAS - Outlook for Building Construction Projects

While not as notable as the other eastern states, VIC/TAS also has a positive stream of construction activity. In the next financial year, the total year’s construction activity should total $7.8 billion, a 3.5 per cent increase.

WA and SA are wavering around the same levels with an increase in one year being balanced by a subsequent decrease.

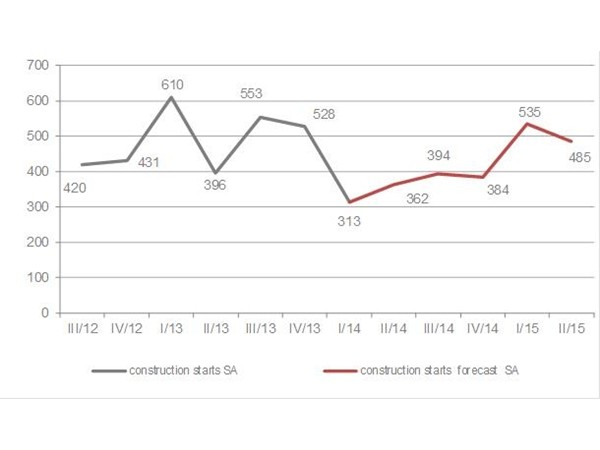

SA - Outlook for Building Construction Projects

SA suffered a big drop in early 2014 which brought the yearly total down 5 per cent from the previous year and we expect this loss to be partly recovered in 2014/2015.

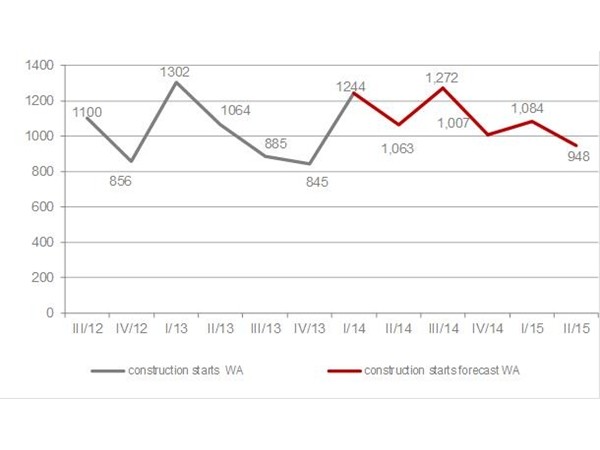

WA - Outlook for Building Construction Projects

In WA, the building market is more robust than civil engineering. Like SA, building construction starts dropped in 2013/2014 but 2014/2015 should return to $4.3 billion, the same as 2012/2013.

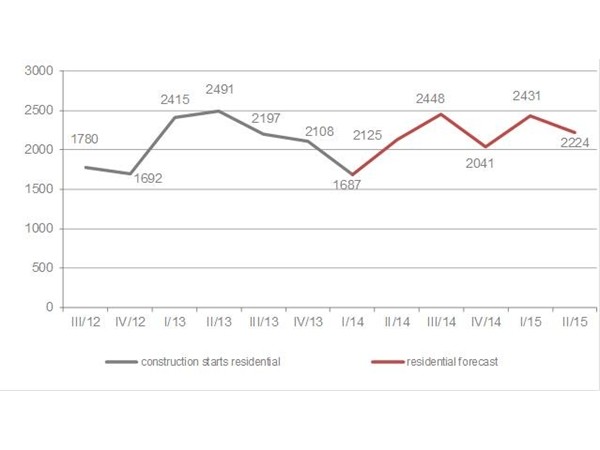

Multi-unit Residential

By far Australia’s biggest building sector, residential building, is forecast to grow by 13 per cent but the stories vary from state to state.

NSW/ACT has the busiest and strongest growing residential building market. Next year it will account for 30 per cent of the national market and has the most consistent upward trajectory.

VIC/TAS is also forecast to improve in 2014/2015 but to a lesser extent with 15 per cent growth.

QLD/NT residential dropped considerably in 2013/2014 but is set to more than recover next year with over $2.3 billion of work in the pipeline.

The picture is not as clear for WA and SA residential construction starts with individual houses still outnumbering apartments/units.

Australia - Outlook for Multi Dwelling Residential Projects

BCI Australia provides crucial construction information, project leads and a powerful online CRM solution to building product suppliers, contractors and related organisations within the Australian construction industry.

Their team reports and researches Australian construction projects - within the public and private sectors - from concept design and planning stages to documentation, tender, the awarding of contracts and commencement of construction.