Increasing levels of consumer caution and weak dwelling price developments are the cause of the sharp deterioration in Australian housing renovation activity and investment, according to a Discussion Paper released by the HIA Economics Group.

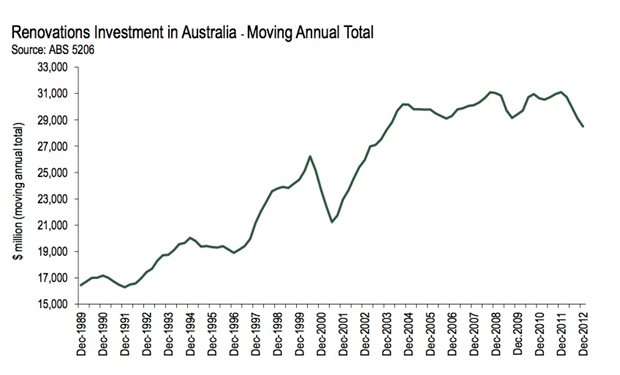

The Renovations Activity – The Recent Deterioration and Outlook paper, an amended extract from the autumn edition of the National Outlook publication, suggests the renovations sector held up reasonably well during the GFC and has grown substantially since the mid-1990s.

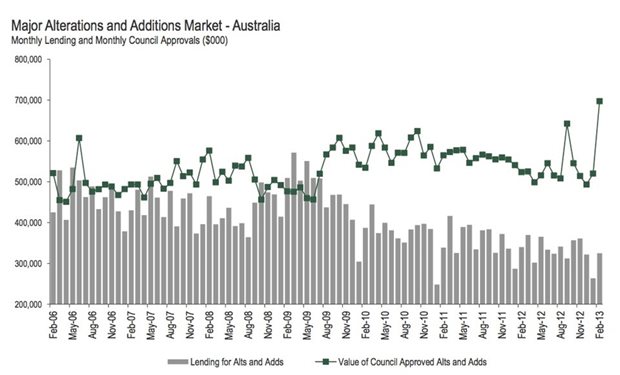

In the past year, however, the paper says two important shifts in the market, resulting from the post-GFC fallout, lie behind a slump in activity.

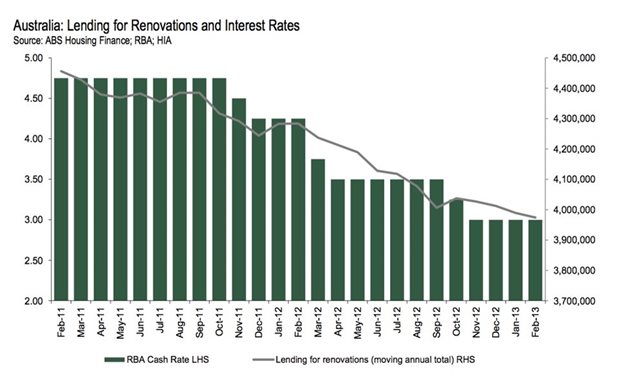

First, heightened levels of consumer caution have seen household choosing to pay down debt more quickly than they previously did rather than borrow to finance home renovations and improvements.

This is demonstrated, the paper argues, by the increased household savings rate – now at around 11 per cent, compared with a negative rate just prior to the GFC.

The second key shift, according to the HIA, is a weakness in dwelling price developments, which they say have limited the ability of consumers to finance renovations by borrowing against home equity.

“In the years prior to the GFC, households were accustomed to renovating in a rising dwelling price market where they could borrow against rising equity,” the paper says.

“In the first instance, soft prices affect a household’s confidence to make significant capital investments into their homes. However, when combined with banks’ now reduced appetite to lend, home valuations have been low, therefore restricting the ability of households (those that actually do want to renovate) to borrow.”

The HIA says the extent to which the deleveraging has run its course and the depth and duration of concerns over employment are unclear. They believe the higher savings rate is here to stay and households will need to continue to acclimatise to the post-GFC environment.

However, with 2012 representing the lowest year in terms of renovations investment in almost a decade and overall levels of housing renovations activity expected to remain subdued for at least two years, the HIA also argues the extent of the recent deterioration cannot be ignored.

“We believe the flat December result in total renovations investment represents a stabilisation to lower levels of activity that will be continued into the medium term,” the paper says.

“We expect that following the sharp decline suffered in 2012 (down by 8.4 per cent to $28.5 billion), total investment into renovations will rise by a modest 1.9 per cent to $29.0 billion in 2013 and remain around this level into 2015.”

Over time, the HIA hopes lower interest rates will support the bottoming out and eventual uplift in renovations lending.